Compliance

Easily comply and monitor your compliance

with complex regulatory frameworks.

Overview

How it works

The ClearSkies™ Secure Web Portal (SWP)’s user-friendly centralized interface allows you to

- effortlessly navigate the requirements of the Standards and Regulations,

- define their scope,

- review their status, and

- identify actions for timely remediation.

Real-time monitoring of your compliance status through customizable dashboards and reports enables a broad compliance overview, making it easy to spot gaps and manage them appropriately, performing full audit on Compliance Administration. Out-of-the-box reports empower you to meet, validate and demonstrate compliance to the appropriate regulating bodies. This helps with upholding compliance with each requirement separately as well as granting you full control over your compliance status.

Furthermore, ClearSkies™ Big Data Advanced Security Analytics Platform features secure collection and consolidation of log data (data in transit is encrypted and masked for security and confidentiality) together with File Integrity Monitoring (FIM), for maintaining an audit trail of who did what and where.

Additionally, it utilizes analysis of log data collected with the use of in-depth User & Entity Behavior Analysis (UEBA), Artificial Intelligence, Predictive and Machine Learning models, for the early detection and response to targeted attacks and data breaches before it is too late.

Finally, automated alerting channels enable quick notifications on your compliance status as well as security incidents, helping you to address notification obligations and to timely coordinate responses.

At a glance

Supported regulatory compliance requirements

GDPR

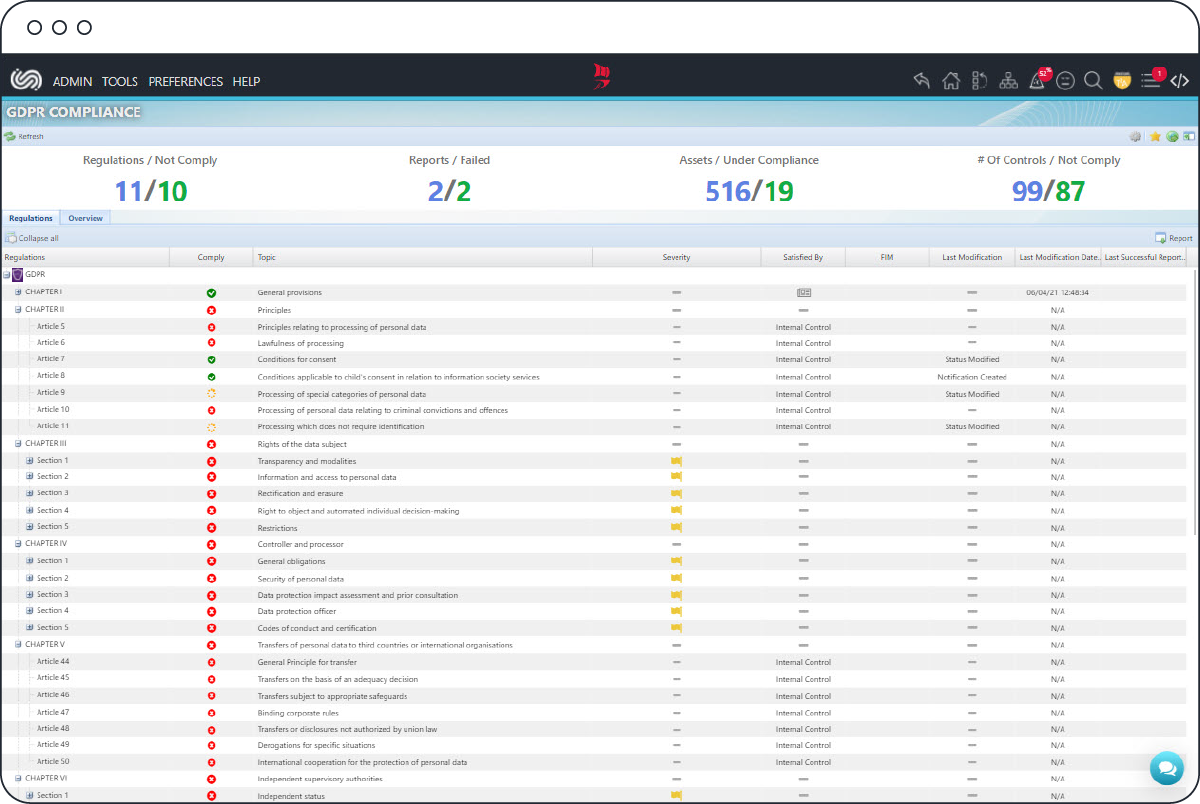

The General Data Protection Regulation (GDPR) (Regulation EU 2016/679) aims to harmonize and modernize data protection regulations for the citizens of the European Union (EU) with respect to privacy and security. It increases their rights regarding their personal information.

The GDPR affects all organization that collect and/or process EU citizens’ personal information. Should they fail to meet and demonstrate GDPR compliance, hefty fines may apply, of up to €20 million or 4% of annual turnover, whichever is greater.

PCI DSS

The Payment Card Industry Data Security Standard (PCI DSS) is a set of comprehensive requirements designed to ensure that all organizations that store, process and/or transmit cardholder data operate in a secure environment. Organizations that fail to comply with the PCI DSS, and have the security of their card payment process compromised may face hefty penalties and fines. In addition, merchants whose card payment process is not PCI DSS compliant, run the risk of losing their ability to accept credit card payments.

To comply with the PCI DSS, organizations must be able to manage access control, encrypt cardholder data, and audit cardholder data at rest in an array of intricate requirements. Due to the shortage of resources and the considerable ongoing administration needs emerging from the amount of yearly transactions on your PCI network, organizations are challenged in their task to achieve PCI DSS compliance.

ISO 27001

ISO 27001 is the internationally recognized Standard for Information Security designed to provide organizations with a comprehensive framework and best practice guidance towards implementing an Information Security Management System (ISMS). ISO 27001 can be implemented in any kind of organization, small or big, profit or non-profit, private or state-owned. The Standard itself is supported by a certification framework through which organizations can be certified and be subject to an audit by an authorized body.

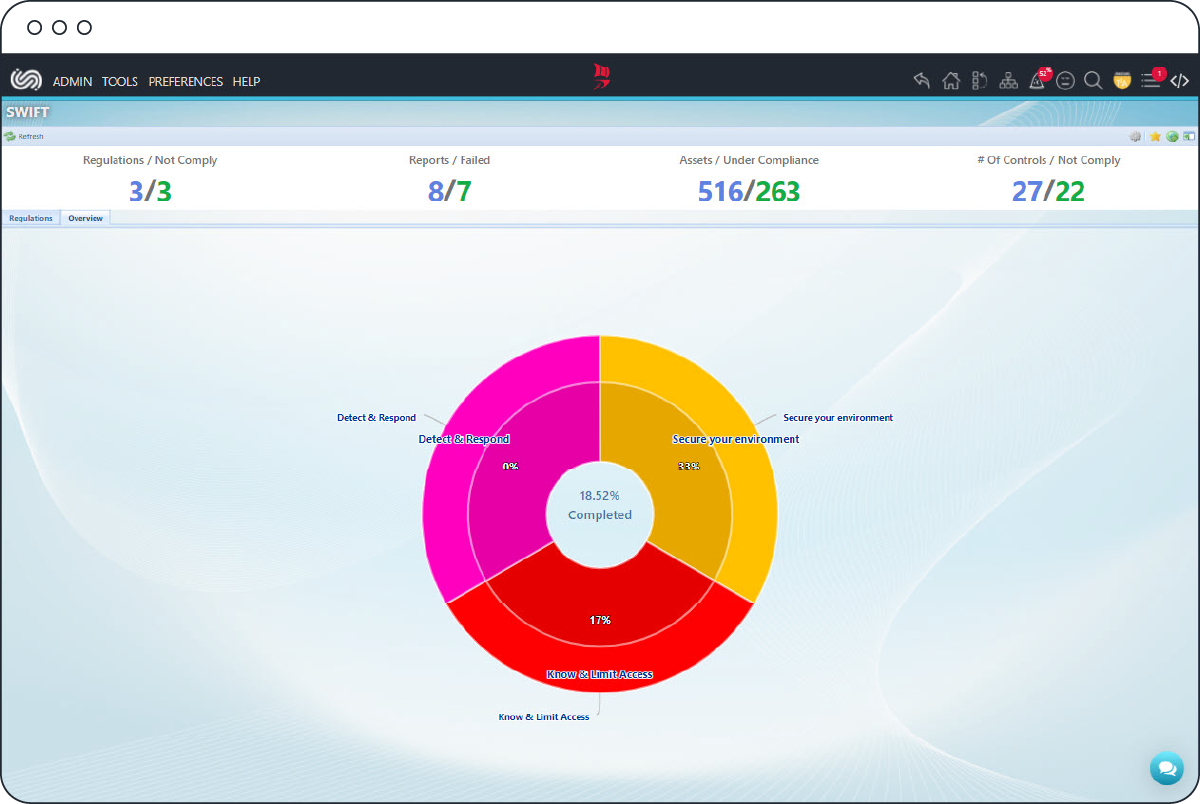

SWIFT

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) ‘Customer Security Controls Framework’ consists of 16 mandatory controls, such as multifactor authentication and continuous monitoring, and 11 recommended controls, including vulnerability scanning, as a response to large-scale cyberattacks against financial institutions. It is enforced to all of SWIFT member banks across 200 countries, and the upholding of these controls is transparent amongst members through the entire SWIFT messaging platform. The Standard includes controls for securing the organization’s environment, limiting access to relevant data, knowing who accessed what and when, and detecting and responding to cyberattacks.

HIPAA

The Health Insurance Portability and Accountability Act (HIPAA) is a set of 154 regulatory requirements, and mandates how electronic protected health information (ePHI) is to be handled by private organizations, related to security and privacy. It applies to any organization which handles personal information regarding healthcare, due to its sensitive nature. This includes hospitals, clinics and insurance companies, all of which must comply with HIPAA when transmitting, processing and storing electronic protected health information (ePHI). Failure to comply may result in legal and financial damages, as well as a compromised business reputation.

FISMA

The Federal Information Security Management Act (FISMA) is a regulatory framework for US federal agencies, defined specifically for the cybersecurity of government information, systems, operations and assets. It holds agencies responsible for taking steps towards information security from human threats, as well as natural disasters. This means adopting cost-effective policies and procedures for ensuring an acceptable information security risk level against unauthorized access, use, disclosure, disruption, modification or destruction of data, thus maintaining integrity, confidentiality and availability.

Demo request

See it in action!

Request a live demo from our representatives to experience the value of ClearSkies™.